how much is inheritance tax in oklahoma

While 14 states have a separate estate tax only 6 states have an inheritance tax. However the new tax plan increased that exemption to 1118 million.

States With No Estate Or Inheritance Taxes

The fact that Oklahoma does not have an inheritance tax means that the states resident does not have to pay any taxes when they inherit an estate located in the state that.

. Your estate is worth 500000 and your tax-free threshold is 325000. Inheritance tax usually applies when a deceased person lived or owned property in a state. States levy an inheritance tax.

Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania. The tax rate varies. The Inheritance Tax charged will be 40 of 175000 500000 minus 325000.

How Much Is Inheritance Tax In OklahomaYou can also join us for a free seminar to. The federal annual gift exclusion is now 15000. Oklahoma Income Tax Calculator 2021.

There is no inheritance tax Oklahoma. And remember we do not have. No estate tax or inheritance tax Arkansas.

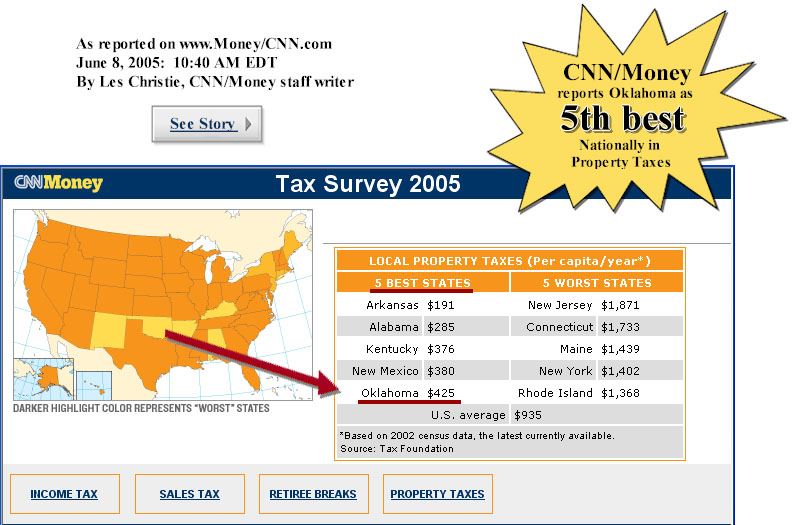

The statewide sales tax in Oklahoma is 450. How much is inheritance tax in the state of Oklahoma. Only six US.

Get a FREE consultation. No estate tax or inheritance tax California. In addition to the repeal of the estate tax the Oklahoma inheritance tax has an exemption amount of 5000000.

Six states collect a state inheritance tax as of 2022 and one. No estate tax or inheritance tax Alaska. Spouses are also completely exempt from the inheritance.

No estate tax or inheritance tax Arizona. Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount. The estate can pay Inheritance.

Postic is an attorney at Postic Bates PC. Your average tax rate is 1198 and your. Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law.

As explained above in 202021. For tax year 2017 the estate tax exemption was 549 million for an individual or twice that for a couple. The federal estate tax exemption for 2018 is 56 million per person.

His practice focuses on estate planning probate real estate trust administration business. Although there is no inheritance tax in Oklahoma you must consider whether your estate is large enough to require the filing of a. State inheritance tax rates range from 1 up to 16.

If you make 70000 a year living in the region of Oklahoma USA you will be taxed 11520.

Assessor Of Oklahoma County Government

Oklahoma Tax Rates Rankings Oklahoma State Taxes Tax Foundation

Oklahoma Probate Law Q A Part 3 Gary Crews Tulsa Probate Attorney

State Estate And Inheritance Taxes Itep

Estate Planning Tulsa Tax Preparation Oklahoma Ok

Estate And Inheritance Taxes In Oklahoma Basic Ideas Managing Opti

Free Oklahoma Estate Planning Checklist Word Pdf Eforms

Oklahoma Retirement Tax Friendliness Smartasset

Property Value Increases Can Trigger Estate Tax Exposure Oklahoma Estate Planning Attorneys

Oklahoma Income Tax Calculator Smartasset

State Estate And Inheritance Taxes Itep

Severance Taxes Urban Institute

Where Not To Die In 2022 The Greediest Death Tax States

Oklahoma Estate Tax Everything You Need To Know Smartasset

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Does Oklahoma Collect Estate Or Inheritance Tax

Complete Guide To Probate In Oklahoma

Inheritance Tax Oklahoma Estate Tax Estate Planning Lawyer

Eleventh Biennial Report Of The Oklahoma Tax Commission For The Period Beginning July 1 1952 And Ending June 30 1954 Archives Ok Gov Oklahoma Digital Prairie Documents Images And Information